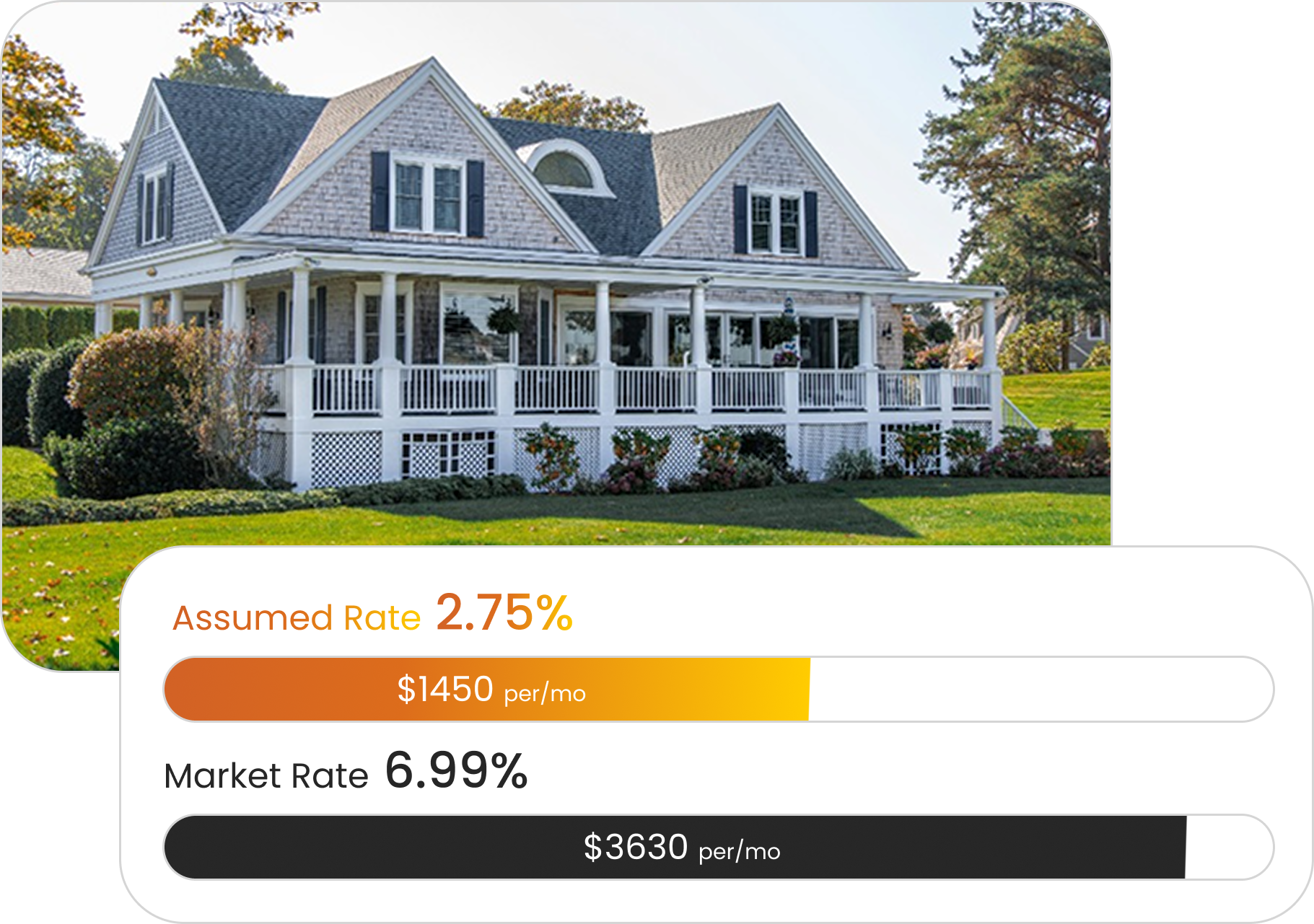

Buyers, cut your mortgage payments in half!

In today's high interest rate market, UMe connects buyers with assumable mortgages, helping you lower payments and avoid high interest rates while securing your dream home.

Explore all listingsMaking home ownership affordable again

Our mission is to revolutionize the real estate experience through assumable mortgages, making homeownership affordable again.

We empower buyers, sellers, and real estate agents with the knowledge and resources to make informed decisions and achieve their homeownership goals. Transparency, efficiency, and education are the cornerstones of our success.

By connecting all players in the real estate market in one convenient place, we simplify the assumable home buying and selling journey.

What is an assumable mortgage?

An assumable mortgage allows you to take over the seller's existing loan, including its current interest rate and terms. This can lead to substantial savings, particularly in a high-interest rate market. Rosin Team eXp Realty's expertise in assumable mortgages ensures you navigate this process seamlessly, securing the best deal possible.

Lower Interest Rates

If the current mortgage rate is lower than current market rates, assuming the mortgage allows the buyer to inherit this lower rate, resulting in lower monthly payments and overall interest costs.

Reduced Closing Costs

Assumable mortgages often have lower closing costs compared to taking out a new mortgage, as there's often no need for a new appraisal, loan origination points or fees, or other associated costs.

Easier Qualification

Assuming a mortgage can be easier than qualifying for a new mortgage, especially for buyers who might not meet today's stricter lending criteria or have less-than-perfect credit.

Flexibility For Sellers

For sellers, having an assumable mortgage can make their property more attractive to potential buyers. This increased pool of qualified buyers can lead to a quicker and more profitable sale.

Ready to buy with Rosin Team eXp Realty?

Buying with Rosin Team eXp Realty is simple and stress-free. Search and secure your dream home in a few easy steps.

FHA and VA Assumable Mortgages

Both FHA and VA loans are assumable under most conditions. FHA loans are attractive for their lower rates and flexible eligibility, while assumable VA loans offer competitive rates — and you don't need to be a veteran to assume one! When considering an assumable mortgage, it is essential to understand the specific conditions and requirements for the assumption process of each loan type and that is where we come in.

Step 1

Explore assumable mortgage listings

Find eligible homes with rates well below current market rates. Discover homes eligible for assumption with rates well below current market standards. Start finding your dream home today!

Step 2

Get pre-screened to assume a mortgage

Get pre-screened quickly with built-in low rates and payments that fit your budget. Our experts guide you through the process of assuming a mortgage seamlessly.

Step 3

Leave the details to us

We take care of working with your agent, the loan servicer, and the sellers.. so you don't have to.

Step 4

Get your keys and smile

Congratulations on your new home! Enjoy the benefits of obtaining a low rate with us.

We collect a buyer paid fee of 1% of the purchase price upon a successful closing and through the transaction closing costs. This assures everyone a simple and stress-free experience.

You get immediate savings.

When you buy with UMe, you don't have any new mortgage loan costs...because there isn't a new loan. Many mortgage lenders charge 1-2% in fees. You've already saved thousands!

You get long term savings.

Most UMe clients can expect to save between $500 and $1,800 per month. That equates to $6,000 to $21,600 per year...every year!

Sooo...what’s the catch here?

None. Buyers Win. Sellers Win.

It's the only true win-win we've seen in the industry since assumptions in the 80's.

Do You Have Any Questions?

Check out this FAQ to get more informationUMe Projects is your pathway to economical home ownership. We guide prospective homeowners to acquire their ideal residence with an inclusive low-interest mortgage.

An assumable mortgage is a home financing option where the buyer takes over the seller's existing mortgage terms. This can be highly beneficial, often leading to lower monthly payments. Certain government-backed loans like FHA and VA loans are assumable, and many are available.

While final approval comes from the current mortgage servicer, UMe Projects will assist in handling communication to ensure a smooth assumption process. Generally, if you qualify for an FHA mortgage, you should also be eligible to assume one.

Once you register, our team will reach out to you and curate a list of properties with low-rate assumable mortgages that match your needs.

In times of high interest rates, taking over an existing mortgage with a rate as low as 2% can result in significant savings. An assumable mortgage allows you to secure your dream home without overpaying on interest.

UMe Projects charges 1% of the home's sale price, paid by the buyer at closing. Our team takes care of everything—matching you with the right properties, handling paperwork, and connecting you with lenders if necessary. No cost or obligation to browse listings!

Yes. Buyers must cover the seller’s equity, which is the difference between the sale price and the remaining mortgage balance. This can be paid in cash or through a secondary mortgage. UMe Projects can connect you with lenders for financing options.

FHA and VA loans are assumable by default. UMe Projects specializes in assisting buyers with assuming these types of loans.

© Listing Service, All rights reserved. The data relating to real estate for sale on this website comes in part from the Listing Service. Real estate listings held by brokerage firms other than Rosin Team eXp Realty are marked with the Listing Service logo and detailed information about them includes the name of the listing brokers. All information deemed reliable but not guaranteed and should be independently verified. All properties are subject to prior sale, change or withdrawal. Neither listing broker(s) nor Listing Service shall be responsible for any typographical errors, misinformation, misprints and shall be held totally harmless.

UMe Realty Group © is committed to and abides by the Fair Housing Act of Equal Opportunity.